Configuring Tax Rates & Tax Overrides

With Wholster, taxes rates are pulled directly from Shopify, so any rules you can configure, including the special tax cases define-able in the customer section of your Shopify admin, will be pulled into Wholster correctly.

https://help.shopify.com/en/manual/taxes

In the case that Shopify’s automatic tax calculation does not work for your business, you can set up tax overrides in Wholster.

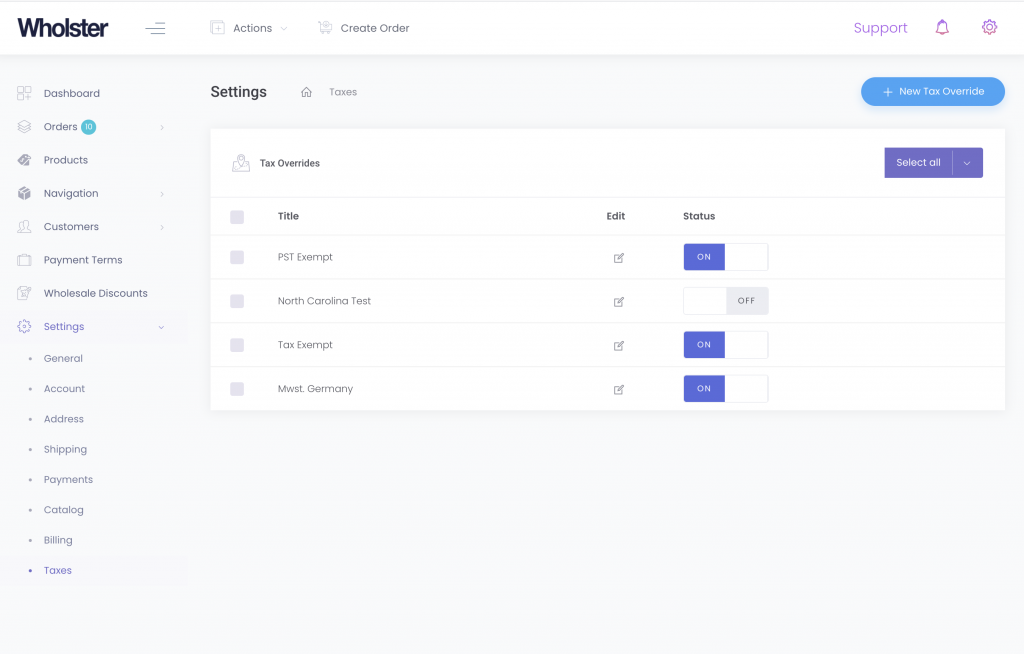

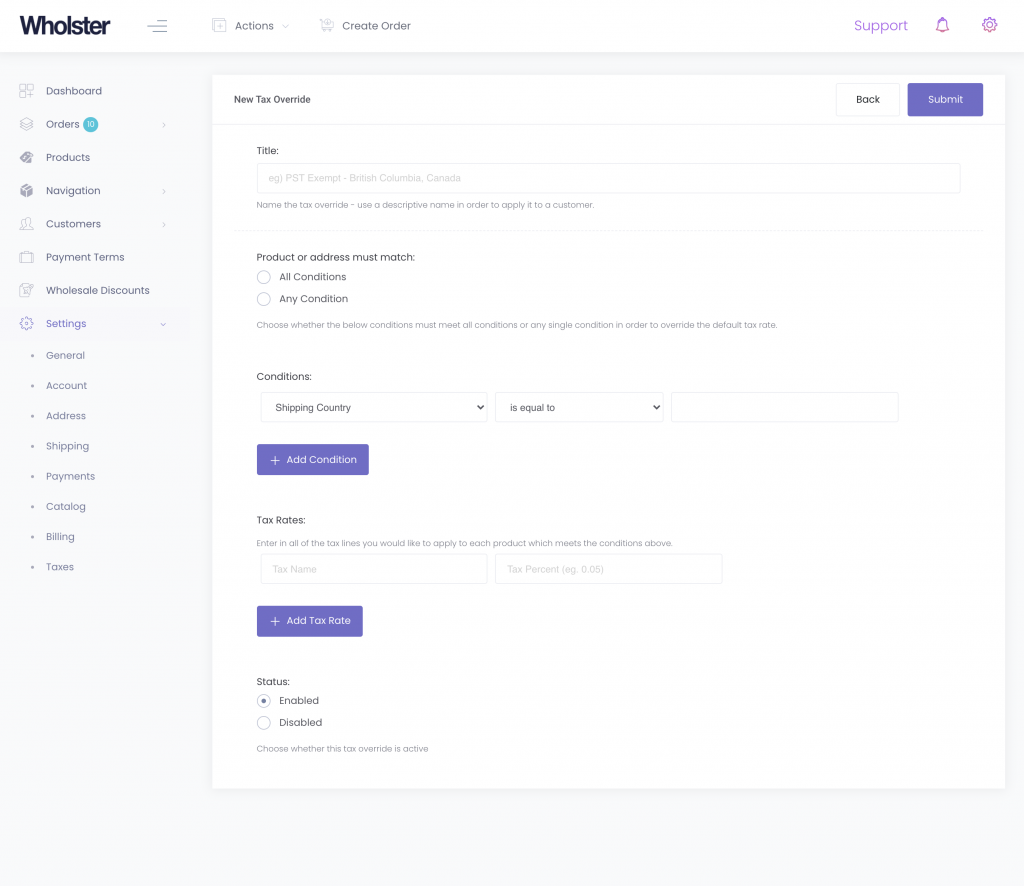

To set up a new tax override, navigate to Wholster Admin -> Settings -> Tax Overrides, then click the “New Tax Override” link in the top right hand corner.

When setting up the tax overrides, define any conditions that must be met in order for the tax override to take effect, along with the tax rates that should be applied to the order.

Taxes configured in this section will always be applied “On top of” the purchase prices, instead of “Included in”. This is useful for European accounts, where tax rule applications differ between retail and wholesale.

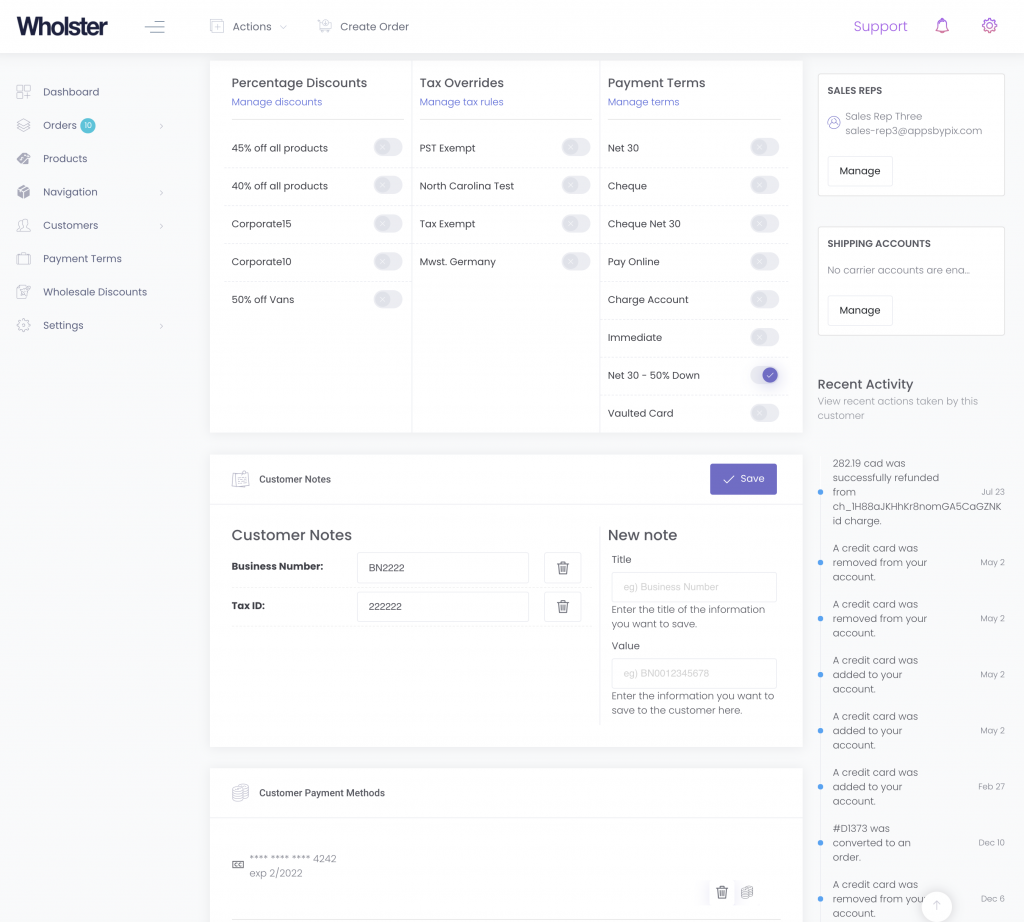

Once you configure the tax override, you will need to apply it to the customers account. This is done by navigating the Wholster Admin -> Customers, then clicking on the customers name.

In the “Tax Overrides” section of the customer overview, toggle any configured tax overrides into the “on” position, in order to apply them to their account.